Private equity investment company scheme

u

u

TAXATION AT THE REDUCED RATE OF 10% ON INTEREST FROM SECURITIES GIVING

ACCESS TO CAPITAL

In addition to the almost total exemption for dividends (see § holdings), private equity companies benefit from a reduced tax rate of

10% for financial earnings and capital gains from securities “giving access to capital”. Specifically concerned by this reduced tax rate

are convertible bonds, bonds with warrants (OBSA), convertible bonds and/or exchangeable for new or existing shares (OCEANE), bonds

redeemable in shares (ORA), bonds with redeemable share subscription warrants (OBSAAR)...

NB: the reduced rate of 10% applies to the gross amount of interest received; expenses (management fees, costs of refinancing... ) remain deductible under ordinary

law for determining taxable income at the standard rate of 20%.

u

u

TOTAL DEDUCTION OF FINANCIAL EXPENSES

Saint-Martin tax regulations do not contain any provision to prevent the deduction of financial expenses related to the acquisition of

shareholdings or securities.

u

u

ABSENCE OF ANY WITHHOLDING TAX ON INTEREST FROM SAINT-MARTIN SOURCES

PAID TO NON-RESIDENTS

Interest paid to beneficiaries resident outside Saint-Martin does not give rise to the application of any withholding tax at the time of

payment.

u

u

POSSIBILITY OF OFFSETTING WITHHOLDING TAX LEVIED ABROAD EVEN IN THE

ABSENCE OF A TAX TREATY

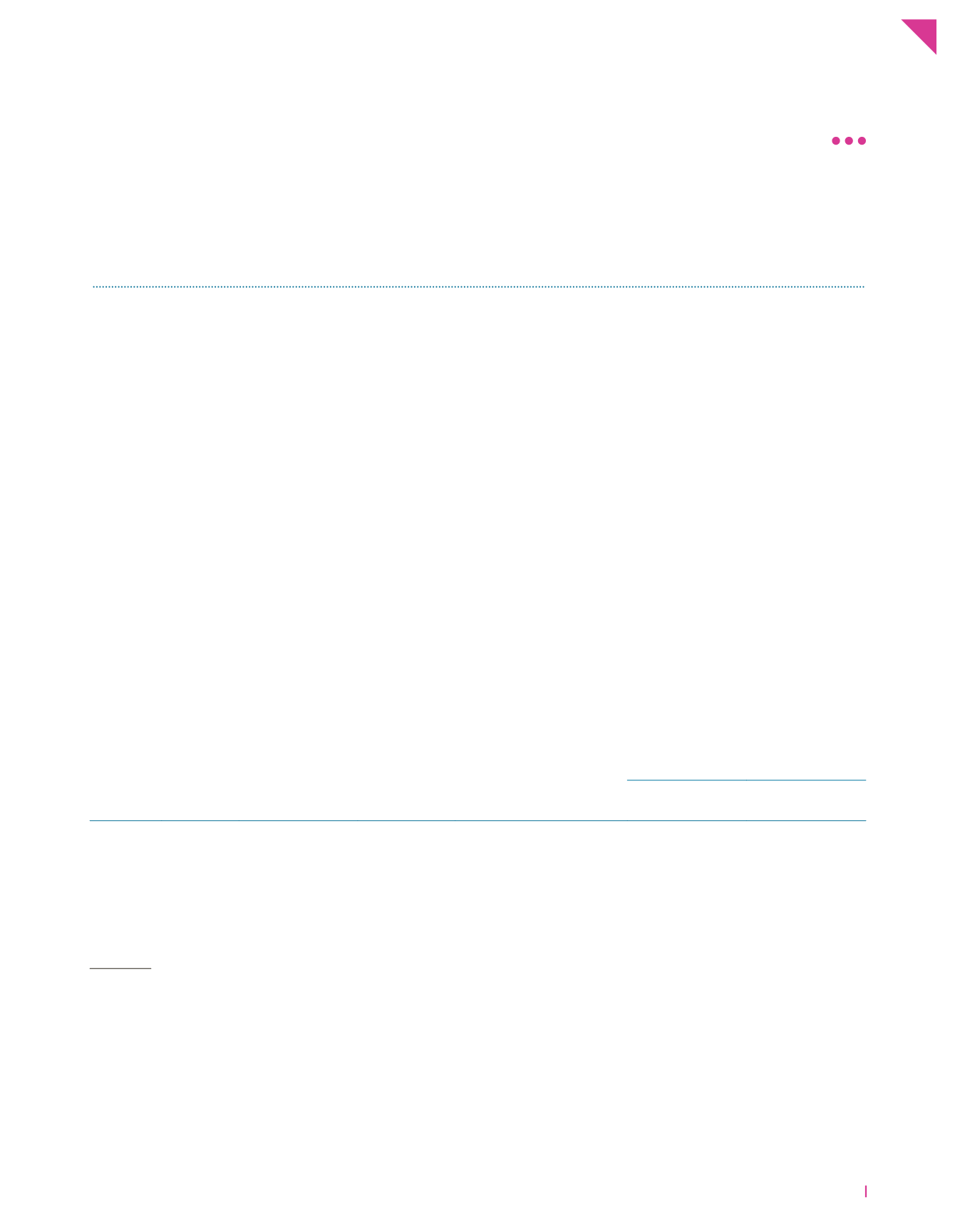

A company is paid interest during the year ended 31 December N, some of which is eligible for the reduced rate of 10% (interest from

countries A and B) according to the following table:

FOCUS ON

Country

of origin

Gross

amount

(1)

Tax levied in the

country of origin

(2)

Net income

(3)

Saint-Martin tax

on income

(4)

Tax credit applied to corporate tax

due in Saint-Martin

On corporate tax

due for the year N

(5)

On corporate tax for

the following years

(6)

Country A €400 000

€60 000

€340 000

€40 000

€400k x 10%

€28 000

€12 000

Country B €600 000

€120 000

€480 000

€60 000

€600k x 10%

€42 000

€18 000

Country C €200 000

€10 000

€190 000

€30 000

(€200k- €50k) x 20%

€7 000

€3 000

Country D €500 000

€100 000

€400 000

€60 000

(€500k – €200k) x 20%

€42 000

€18 000

Comments:

Column 4:

the amount of tax credit is in any event capped at the amount of Saint-Martin tax on the taxable income in question (difference between,

on the one hand, the gross amount mentioned in column 1 and, on the other hand, expenses deductible from income under Saint-Martin domestic

legislation such as management expenses and refinancing charges). For shares eligible for the reduced rate of 10% (Country A and Country B) such

charges are deemed to be nil.

Column 5

et

Column 6:

Tax deducted at the source in the foreign country, capped if appropriate (see Col 4), is offset for up to 70% of the amount of

corporate tax due under the year N; the balance (30%) increased, if appropriate, by the fraction that could not be offset under the year N, is carried forward

to following years indefinitely and for an unlimited amount.

17

MARCH 2015 EDITION

VERY FAVORABLE CORPORATE TAX